Lume Capital is a renowned crypto venture capitalist company that provides a range of investment options to help investors achieve their financial goals.

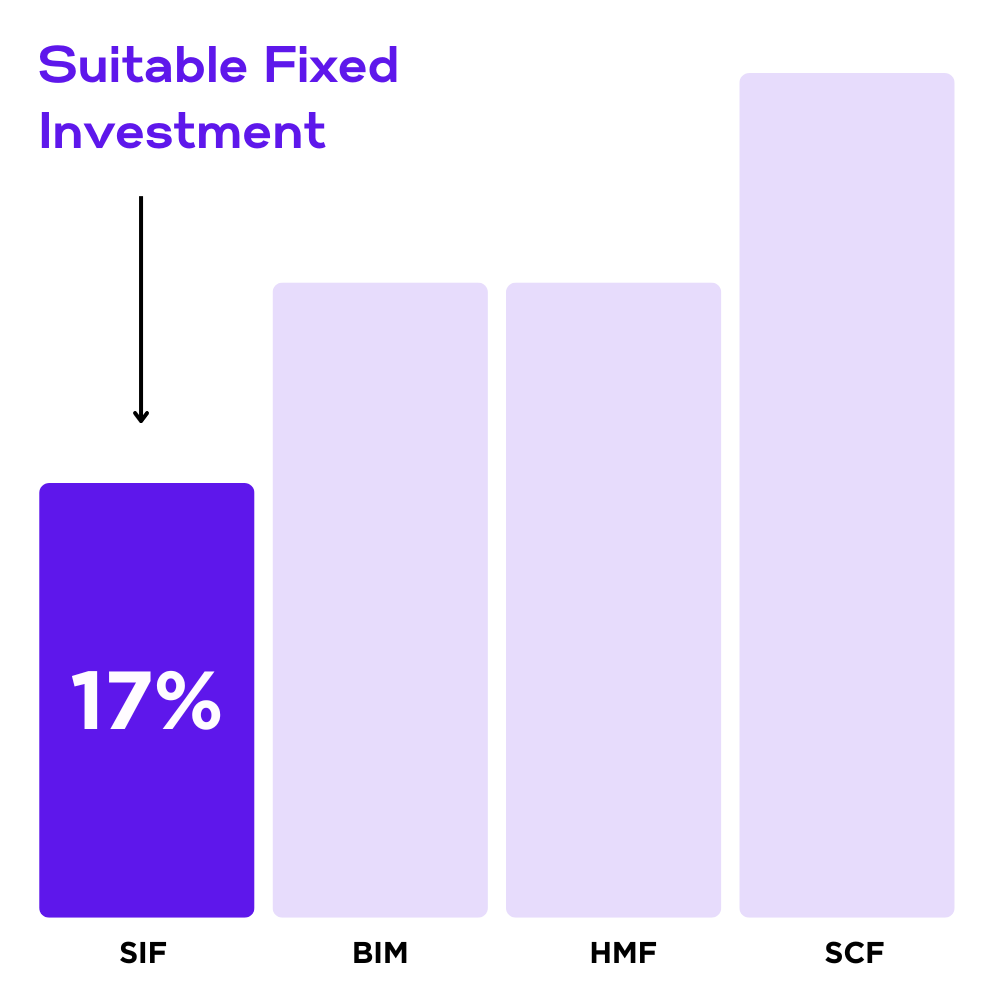

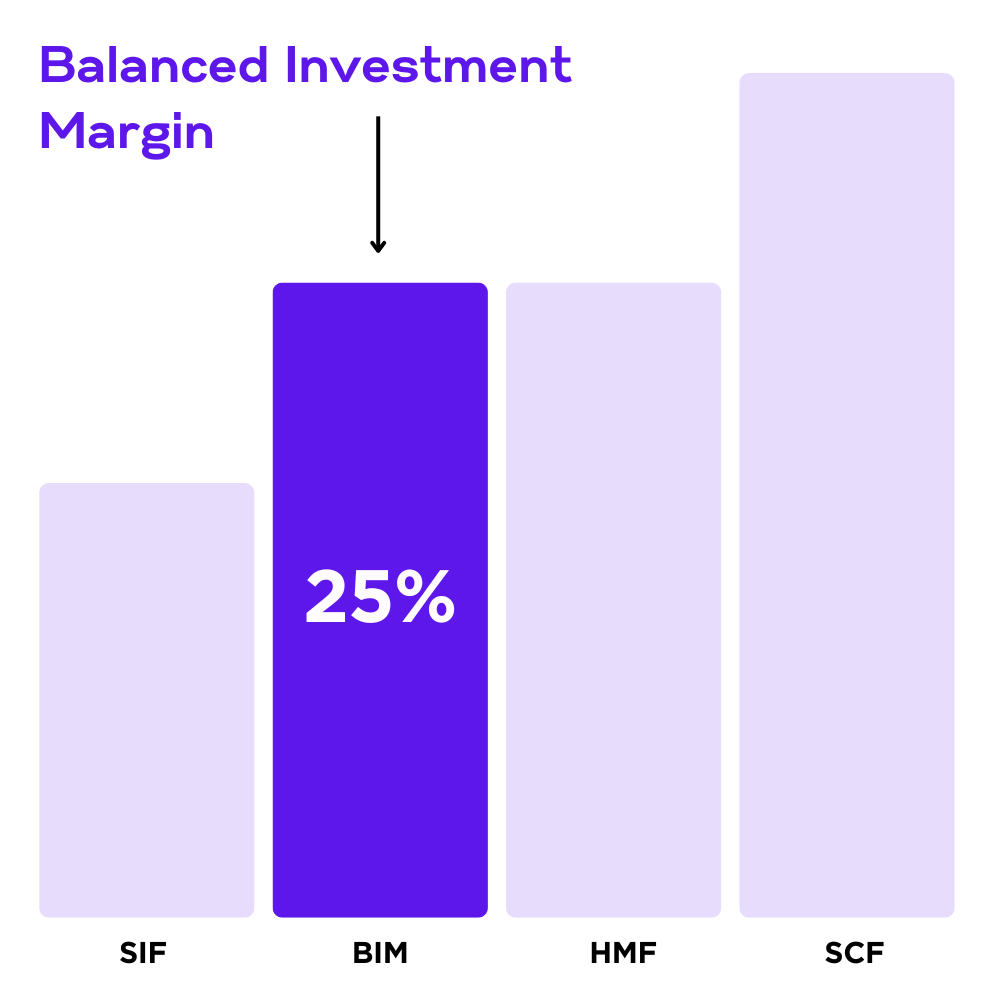

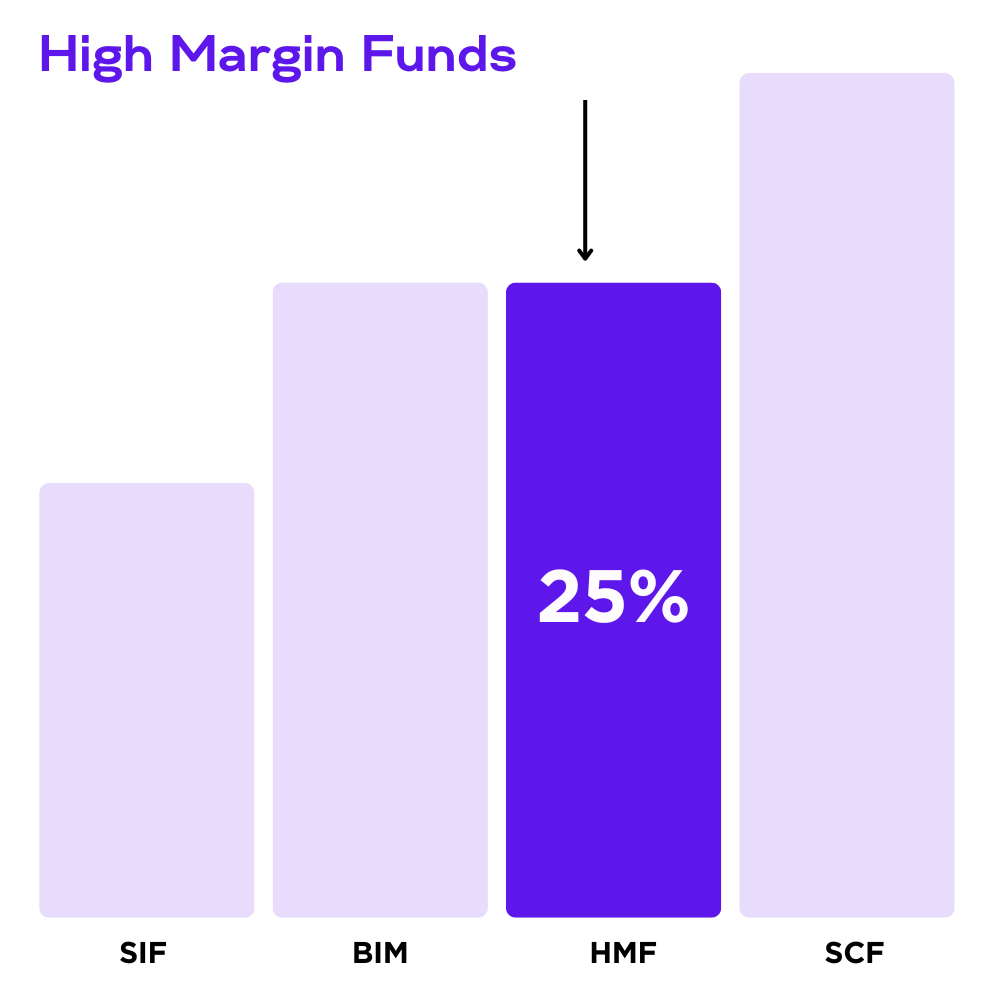

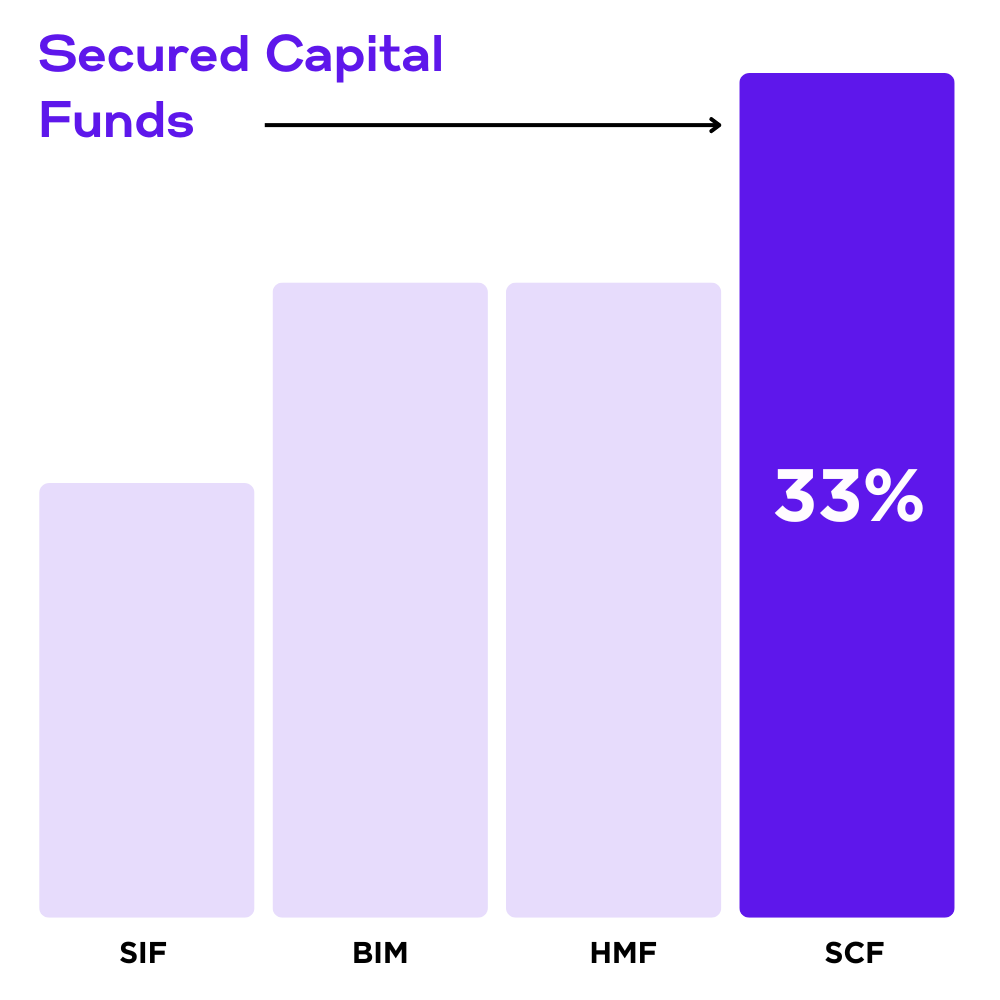

Selecting the right investment mix is crucial for achieving financial success, and Lume Capital offers a variety of options to cater to different investment preferences and risk tolerance levels.